In this blog post, I will write about why a 529 plan contribution may be the best gift you can give your child. I will discuss the minimum contribution required in the State of Michigan and different ways you can choose to fund your plan. I will also give some advice on how to determine how much money you should be contributing to a 529 plan to meet your goals.

Every Christmas you spend money on the latest and greatest toys. Maybe it’s a Furby or Fingerling, or whatever the popular toy of the year may be. A lot of times the gift is awesome for maybe a week or, if you’re lucky, a month. And depending on how old your child is, sometimes they end up playing with the box or wrapping paper more than the toy itself. Why not instead spend that money toward your child’s college education by making a 529 plan contribution? Though they may not appreciate it now, my guess is they will later on if they aren’t still struggling to pay off college loans at the age of 30.

If you aren’t familiar with the many benefits of a 529 plan, check out my previous post, 5 Reasons to Save for College with a 529 Plan. Once you decide to open a plan, you have to make three key decisions before the final step of actually funding the account.

What are the Options for Funding a 529 Plan?

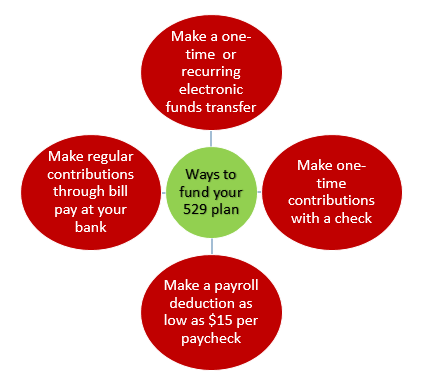

In Michigan, you can open a 529 savings plan with as little as $25. There are several ways to fund your plan, with the most common ways outlined below.

Additionally, when family and friends ask for gift ideas, you can encourage them to contribute to your child’s account by providing some key information and having them complete a gift deposit form. For detailed information and step-by-step processes for all of these options, visit the Michigan Education Savings Program website.

How Much Should You Contribute to a 529 Plan?

Now that you know how easy it is to fund a plan with as little as $25, the question that remains is how much money should you put in your child’s 529 plan to fully fund it? The answer, unfortunately, is that it depends. However, there are some key questions to answer that will help you decide.

How much do you want to contribute toward college?

Some parents want to fund all of their child’s education expenses, while others prefer to only fund a portion and teach their children to save for the remainder. Deciding how much you wish to have saved up by college is the first choice you need to make. This may start with a financial plan to see how much you can afford to contribute toward college, given your other goals.

How many children do you have?

Over-funding a 529 plan can be dangerous since the funds can only be withdrawn for qualified higher education expenses, and are otherwise taxed and penalized. However, if you have multiple children, I often recommend funding the oldest child’s 529 plan more than the other accounts because if the first account is over-funded, you can easily transfer the excess funds to a sibling.

Do you know which school your child will most likely attend?

Community colleges are much less expensive than public schools, and some public college pricing varies greatly, not to mention that private colleges often cost even more. If your goal is to fully fund college education, deciding how much money to fund starts with how much money you will need for college in the future. You then need to consider the inflation rate of those college expenses and factor in the earnings your invested assets will achieve.

The problem is that many parents don’t know which college their student will attend, and often the student doesn’t even know until they have almost graduated from high school (I myself didn’t decide until the very last minute, and even ended up transferring after that!). What I usually recommend is planning to save for the average public college tuition cost in your State.

Will your child live on campus?

529 savings plans can be used for tuition in addition to room and board and other education expenses such as books and laptops. If your child lives on campus, the room and board expense will be much greater than if your child lives at home. Most parents plan for the cost of tuition in addition to room and board, but if you have strong feelings about your child living at home, make sure you only plan for the cost of tuition when funding your 529 plans.

What if your child gets a Scholarship?

We all want our children to earn academic scholarships, or grow up to be the star hockey player or runner earning a full ride scholarship. If that’s the case, what happens to all of those funds you put away for college? You can still use part of the funds for non-scholarship expenses, such as room and board and books. You could choose to use the excess funds for other education expenses such as a laptop, or graduate school. If you have other children, another option would be to transfer the funds to them or you could even save them for a grandchild. If you can’t find a way to spend the excess funds on qualified education expenses, don’t worry because you can withdraw the funds penalty-free. This is a special rule for when scholarships are the reason you don’t spend the funds. However, keep in mind you will still pay tax on the withdrawal, so it’s best to find a qualified expense so your 529 funds can be spent tax-free!

we are here to help if you need it, but don't overthink it - getting started is most important!

Deciding just how much is required to fully fund a 529 plan can require some estimates and analysis on inflation and earnings rates. College planning, including 529 funding recommendations, is included in a comprehensive financial plan with Autumn Financial Advisors, LLC. We will also monitor your 529 plans on an ongoing basis to be sure to discuss any necessary investment tweaks or funding changes along the way.

The bottom line is that saving in a 529 plan early on will be very impactful for your child’s education funding. Don’t overthink all of the details too much. Getting started is the most important step! This Christmas, invest in your child’s future by opening a 529 account. It takes just 15 minutes to open a Michigan 529 savings account, start now by visiting Michigan Education Savings Program's website. Even if it’s just $25 for now, it may prove to be much more useful than the toy you find forgotten under the couch weeks later.