If you are choosing your own health insurance plan, open enrollment typically runs from November 1st to December 15th each year. If you have coverage through your employer, open enrollment can vary based on the company you work for. There are often several factors to consider when choosing a health plan. Here is a guide to some of the decisions you will have to make.

HMO or PPO?

The first thing to consider is if you want an HMO or PPO plan. A Health Maintenance Organization (HMO) provides health services to you through a network of healthcare professionals. In this type of plan, you usually are unable to use providers outside of the network and sometimes you need a referral from your primary care doctor in order to see a specialist. On the other hand, Preferred Provider Organization (PPO) allows you to receive health services outside of your network of professionals, which is less restrictive than an HMO, and also more expensive. If it is very important to you to be able to use a specialist outside of your network, you may want to pay extra for a PPO. Otherwise, an HMO will save you money. If you have a specific primary care doctor that you want to use just make sure that they accept whichever plan you choose, HMO or PPO.

HDHP or not?

A High Deductible Health Plan (HDHP) is one where you will pay lower premiums but you will have a higher deductible than traditional plans. That means that if you incur medical costs, you will have to pay for uncovered expenses in full until your deductible is reached. If you don’t incur many medical expenses, the money you save by paying lower premiums could offset the additional expense you have when you do need care. Another benefit of having a HDHP plan is that you can usually qualify to use an HSA. A Health Savings Account (HSA) is an account that individuals with a qualifying HDHP can contribute to. All contributions are tax-deductible, grow tax-free, and can be used to pay for qualifying medical expenses tax-free. HSA funds roll over year after year and the funds remain yours even if you leave your employer. The tax savings generated from these types of accounts can make an HDHP very attractive.

Catastrophic, Bronze, Silver, Gold, or Platinum?

If you are younger than 30, you may qualify for a catastrophic plan with very low premiums. Keep in mind that you typically have to pay for everything except for preventive care out-of-pocket before reaching your deductible. The deductible on these plans is usually higher than any other available plan. Catastrophic plans are typically not HSA eligible and don’t allow you to use any premium tax credits. If you are healthy and don’t expect any out-of-pocket expenses, this could be a good choice for you.

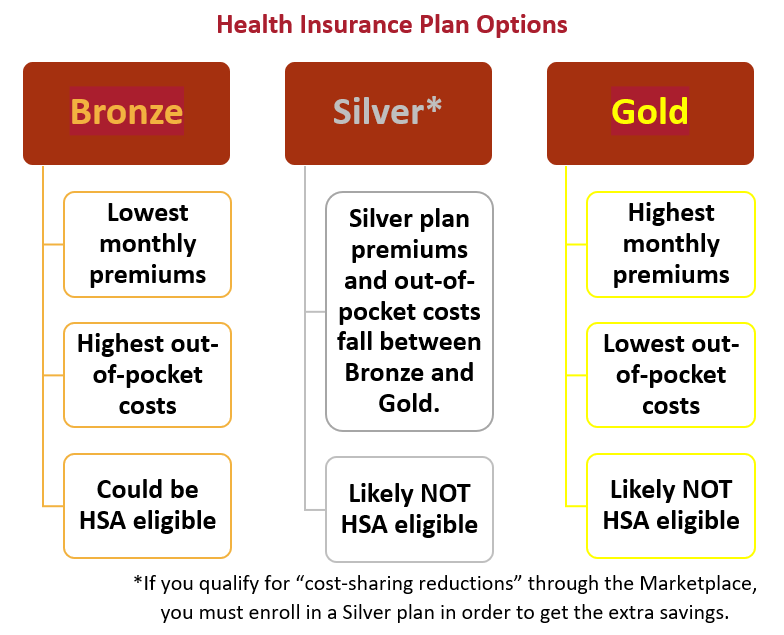

Aside from catastrophic plans, you will generally have the choice between a bronze, silver, or gold plan. Generally speaking, bronze plans will have the lowest premiums and highest deductibles while gold plans will have the highest premiums and lowest deductibles. You may also have the option of a platinum plan, which has the lowest out-of-pocket cost when care is needed but generally has the highest premium as well.

While looking through your plan options, you will likely see references to the following concepts:

Premium: Your premium is what you pay monthly in order to have your health insurance plan. You will pay this amount no matter what, even if you don’t use your plan.

Deductible: The deductible is the amount you have to pay by yourself until your insurance will start paying for anything. This amount resets every year. If you have a family plan, you will likely have a deductible that each individual needs to reach and an overall family deductible. If an individual reaches their deductible but not the family, the insurance will start paying for that individual only. Once the family deductible is met (even if only by one individual), your insurance will start paying for all individuals on the plan.

Copay: A copay is an amount you have to pay to receive certain types of care. For example, you may have to pay $30 each time you visit a primary care doctor.

Coinsurance: After you meet your deductible, you may have to pay for a percentage of your health care until you meet your out-of-pocket limit.

For example, assume Mary has a $500 deductible and 25% coinsurance amount. She has a $600 procedure and hasn’t paid any toward her deductible yet. She has to pay $525 (her full $500 deductible first and then 25% of the remaining $100). If she has another $1,000 procedure later in the same year, she only has to pay $250 (25% of $1,000) since she has already reached her deductible. The insurance company will cover the remaining 75%, or $750.

Out-of-Pocket Limit / Maximum: Your out-of-pocket maximum is the most you have to pay in one year before your health insurance will pay 100%. If you have a family plan, you will likely have an individual out-of-pocket maximum that each individual needs to reach and an overall family maximum. If an individual reaches their maximum but not the family maximum, the insurance will start paying 100% for that individual only. Once the family maximum is met (even if only by one individual), your insurance will start paying 100% for all individuals on the plan.

Premium Tax Credits and Other Savings

If you are NOT eligible for affordable coverage through an employer sponsored plan or government program, your income falls below a certain amount, and you enroll for health insurance through a marketplace, you may be eligible for premium tax credits that will reduce your overall premiums. These apply to bronze, silver, gold, or platinum plans but not to catastrophic plans.

In addition to any premium tax credit you may qualify for, choosing a silver plan can help you qualify for additional savings called “cost-sharing reductions.” This can reduce your copayments, coinsurance, and deductibles only if you enroll in a silver plan.

There are several decisions to make when choosing a health insurance plan that is best for your family. Since there is no way to predict the future, it’s impossible to choose the perfect plan but you can make an educated decision based on the expenses you predict. Consider what you typically pay each year for doctor and specialist visits and prescriptions. If you are healthy, choosing a catastrophic or bronze plan could save you money because of the lower premiums and tax savings of using an HSA. If your costs are quite high due to health issues, choosing a silver, gold, or platinum plan may be better for you.

At Autumn Financial Advisors, LLC, we help clients to review their options and choose the plan best for them. Contact us to learn more about working with us and other ways that we can help you with the many financial decisions you have to make.