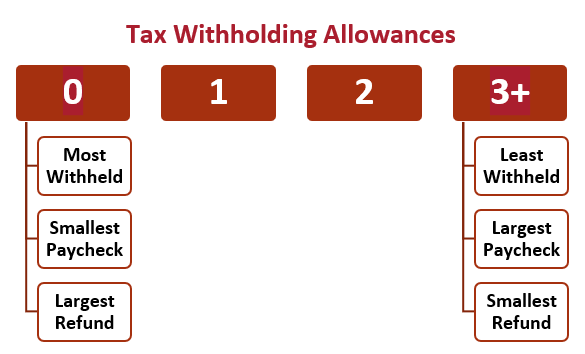

When you first started working for your employer, you probably received a Form W-4, which is officially titled the Employee’s Withholding Allowance Certificate. This tax form allows you to choose to select 0, 1, 2, 3, or more withholding allowances. The number of allowances you select determines how much income tax is withheld from your paycheck. When an employer withholds income from your paycheck, they are removing some money from your paycheck to use it to pay your taxes. You are therefore paying your taxes throughout the year instead of waiting to pay them all in a lump sum at the end of the tax year. Think of a withholding allowance as an exemption from having to pay some tax. When you claim allowances, you are stating that there is a reason that you don’t have to pay the full amount of tax. If you claim 0 allowances, the maximum amount is withheld from your paycheck. The more allowances you claim, the less tax that is withheld, which increases the size of your paycheck and therefore reduces the amount of any tax refund you receive at the end of the year.

How Many Allowances Should I Claim?

The number of allowances you claim depends on several factors such as if you are single or married, how many jobs you work, and how many dependents you have. Generally speaking, if someone else claims you as a dependent, you should claim 0 allowances. If you are single with one job, you should claim 1 allowance. If you are married, you should claim 2 allowances (if each spouse works, the total number of allowances you should claim is 2, or 1 allowance per spouse). If you have children, you should claim 3 or more allowances.

These generalizations that many use to choose their number of allowances can change depending on several factors. In order to help you estimate your withholding more accurately, you can visit the IRS website and use their Withholding Calculator.

There is also the option to withhold a specific dollar amount from each paycheck in addition to your allowances. You can choose to do this on line 6 of the Form W-4 if you want to fine-tune the amount you are withholding to make it more accurate or if you have additional income you’d like to also withhold for.

What If I Withhold Too Much Tax?

If you withhold too much tax, you are basically giving the government a free loan. Instead of loaning the government money, there are several other things you could choose to do with that money throughout the year. For example, you could save more for retirement, pay down your debt, or build up an emergency cash reserve.

What If I Don't Withhold Enough Tax?

If you don’t withhold enough tax, you may owe taxes at the end of the year. If you owe more than $1,000 in tax at the end of the year, you may also have to pay the IRS a penalty for not paying enough throughout the year. This is why it is especially important to make sure you are at least paying enough tax throughout the year.

When Should I Change My Withholding?

You can choose to update your withholding information using the Form W-4 at any time throughout the year. If you become married or divorced, have a child, or change jobs you should update your Form W-4. Usually, if there are major changes to your income, it is a good time to check your tax withholding to be sure it is still accurate.

How Do I Change My Withholding?

In order to update your withholding, you need to complete a new Form W-4 and submit it to your employer.

What If I Am Self-Employed and Don’t Have a Form W-4?

When you are self-employed, you do not have an employer withholding tax for you. Instead, you may be required to make quarterly estimated tax payments to the IRS in order to avoid having to pay a penalty. You can use the Form 1040-ES, or Estimated Tax for Individuals, in order to figure out if and how much you are required to pay in quarterly estimated tax. You can mail in vouchers to make your estimated payments or pay them online through the Electronic Federal Tax Payment System.

How Do I Withhold Tax from Other Income, Such as Pensions?

If you have income outside of your employer, such as a pension, you can also choose to withhold tax from that income. For pensions, you can complete a Form W-4P and give it to the payer of your pension (not to the IRS). Similarly, if you are receiving Social Security benefits and a portion of them are taxable, you can complete Form W-4V. Keep in mind that Social Security benefits are only taxable if your income exceeds a certain amount. If you have other taxable income, such as alimony or large capital gains from selling investments, you can make estimated quarterly tax payments similar to if you are self-employed. Alternatively, if you also have income from an employer, you can increase your withholding to account for your other income as well.

The Bottom Line:

How much tax to withhold can be complicated depending on your situation. Withholding too much can prevent you from using the income for other things throughout the year while not withholding enough can cause you to pay a penalty to the IRS. If you are self-employed or have additional income, it is important to be sure you are paying enough tax on that income throughout the year. Talk to your tax professional to see if your withholding is accurate. Be sure to tell them about any new income you receive during the year and any big changes to your tax situation.

References

IRS Website: https://www.irs.gov/individuals/irs-withholding-calculator