Health Savings Accounts, also known as HSAs, are powerful, triple-tax-advantaged savings tools. Contributions to HSAs are tax deductible, grow tax-free, and can be withdrawn tax-free as long as they are used for qualified medical expenses as defined by the IRS. It doesn’t get much better than that!

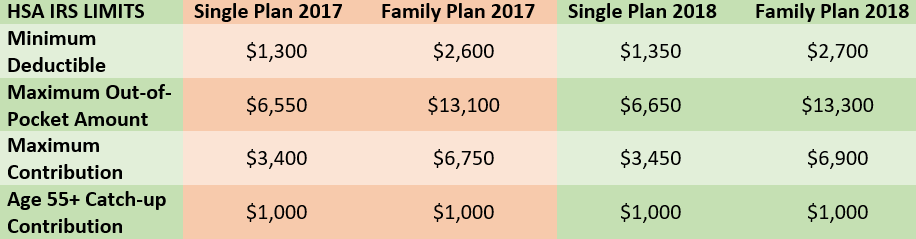

The problem is that not everyone can utilize an HSA. In order to be eligible for an HSA, you must be covered under an HSA-qualified High Deductible Health Plan (HDHP) without other health coverage (with few exceptions). With a HDHP, you are responsible for paying a minimum amount of deductible before your insurance company will kick in to cover expenses. There is also a maximum out-of-pocket limit, which means that people with certain catastrophic plans do not qualify for an HSA. If you qualify for an HSA, there is a cap to the amount that you can contribute each year. The chart below outlines the IRS limits for 2017 and 2018 for both Single and Family plans.

Many people aren't familiar with some important features about HSAs that make them one of the most powerful savings tools.

1. Contributing to an HSA is more flexible than many people realize.

If you qualify, you can open and contribute to an HSA for the prior year until the tax filing deadline. The tax filing deadline for 2017 is Tuesday, April 17th, so you still have time to contribute to an HSA if you haven’t already!

Be sure to report all contributions to an HSA on form 8889. Be sure not to contribute more than the annual contribution limit for the year you are making a contribution, or the excess contribution will be subject to a 6% excise tax.

Unlike most retirement accounts, you don’t have to have income to contribute to an HSA.

As long as you are considered an eligible individual the first day of the last month of your tax year (usually December 1st), you are considered eligible for the entire tax year and can contribute the entire limit for that year. However, if you use this last-month rule, you must remain an eligible individual during the entire next 12 months (through December 31st of the following year). Otherwise, the extra amount will be included in your income and subject to a 10% additional tax.

Even if your employer doesn’t offer an HSA, you can still open one as long as you meet the qualifications. And even if your employer offers an HSA, you can choose to open one somewhere different if you aren’t happy with your options.

2. You can invest HSA funds to be used as retirement savings.

Depending on your situation, it may be most beneficial to invest your HSA funds and pay for medical expenses out-of-pocket now.

The benefit to investing your HSA is that the funds can grow tax-free for longer and be withdrawn tax-free if used for qualified medical expenses.

The bank you have your HSA at may or may not allow you to hold investments but you can always transfer your balance to an HSA provider that allows for investing.

3. HSA funds stay with you even if you leave your employer and can be used to pay for Medicare premiums.

HSA funds roll over year after year and stay with you even if you leave your employer.

Once you are eligible for Medicare, you cannot continue to make contributions to your HSA. However, you can continue to use your HSA funds for qualified medical expenses, including Medicare premiums and deductibles.

Typically, if you use your HSA funds for non-qualified medical expenses, you must pay income tax in addition to a 20% penalty on the funds withdrawn. However, once you reach age 65, you can use your funds to pay for other things. The amount withdrawn for non-qualified medical expenses will be taxable but not subject to the 20% penalty.